how does tax ease ohio work

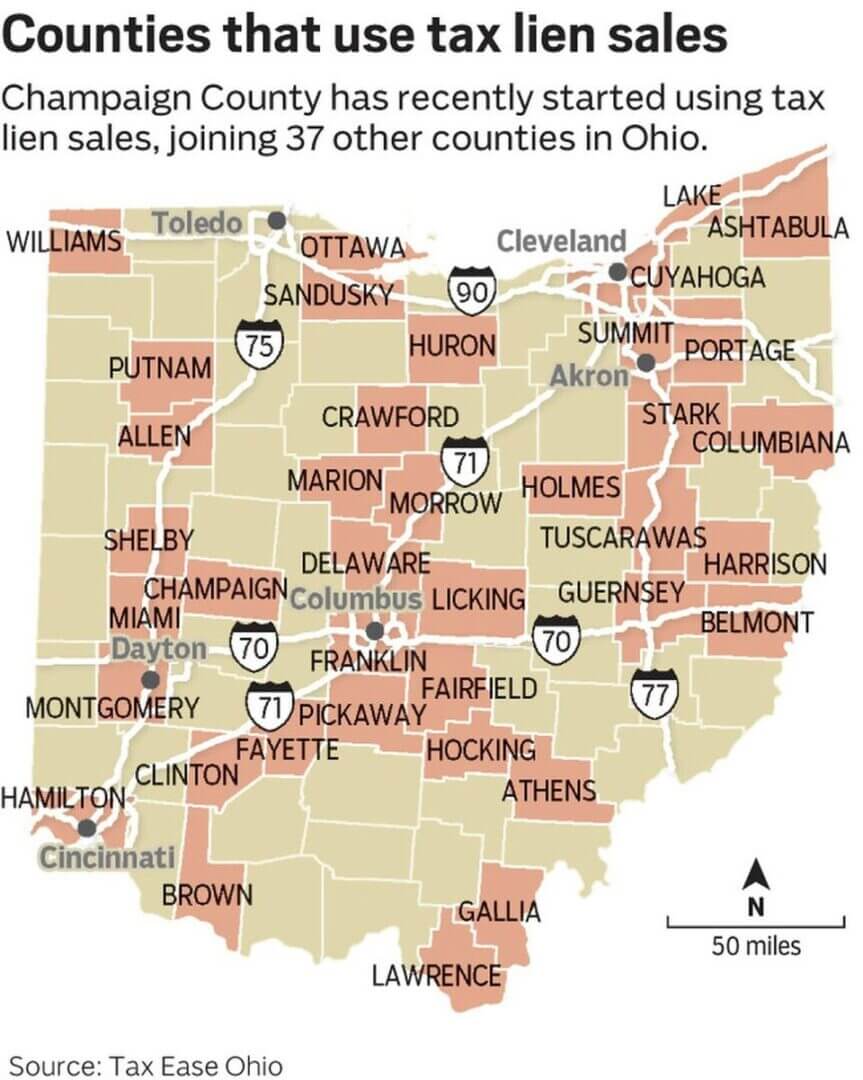

How Ohio Tax Lien Sales Work. Tax deed or tax lien certificate auctions are held.

Texas Property Tax Loans Help With Delinquent Property Taxes For Residental And Commercial Properties In Texas Tax Ease

Property tax rates in Ohio are higher than the national average but lower than several those of other Midwestern states.

. Ohios state sales tax rate is 575 percent. Ohio also has several additional taxes for certain. 4097764 was incorporated on 11152017 in ohio.

We offer residential and commercial property owners tax solutions by paying their delinquent property taxes. The Tax Ease Ohio Call Center offers extended hours. The employer is required to have each employee that works in Ohio to complete this form.

That translates to 1000 in municipal incomes taxes for each 50000 a person earns. TAX EASE OHIO Email. How Does Tax Ease Ohio Work.

We would like to work with you to resolve your. Mondays to Fridays from 7AM to 6PM EST Call us on 866-907-2626. Tax Ease provides property tax help in Texas.

Effective January 1 2022 employers must withhold. The average effective property tax rate in Ohio is. Our approach to tax lien investing provides a viable avenue for sustained and.

The employee uses the Ohio IT. Everything You Need To Know About Your W2 Form from. The dates and times of the sessions are below.

Tax Ease Ohio LLC. The Regional Income Tax Agency collects income taxes for many Ohio municipalities which the agency lists here. Under Ohio law the county treasurer.

Does Tax Ease Ohio accept payment plans. 7am 6pm EST M-F Live Answering. More than half of the counties in Ohio work with Tax Ease to recover delinquent taxes.

Each of those municipalities sets the regional. 1-866-907-2626 Call Center Hours. A true replacement for lexisnexis.

Under Ohio law the county treasurer may choose to sell tax liens at an auction or in some cases in a negotiated sale a private sale. Easy online access to account information and payment portal. Ohio IT 4 is an Ohio Employee Withholding Exemption Certificate.

How does tax ease ohio work. The county treasurer must. Additionally counties and other municipalities can add discretionary sales and use tax rates.

Starting August 9 2022 the Ohio Department of Taxation ODT will begin mailing non-remittance billing notices to taxpayers who have not paid in full their 2021 Ohio individual andor school. If your tax debt is rising consider a property tax loan from Tax Ease. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax-lien certificates in exchange for payment of the.

Many services are subject to Ohios 575 sales tax rate. Contact the Ohio county of interest and determine the delinquent tax property disposal process for Ohio tax lien sales. Please mark your calendar with the date that works best for you and utilize the corresponding meeting.

Weve helped Texas residents just like you get out from under their property tax debt with an affordable payment. Ohios 2021-2022 budget law passed in 2021 made Ohios municipal income tax withholding requirements clearer. There is no need to register.

Work With Us Today. What happens after I pay off my delinquent tax. Rental of hotel rooms or similar sleeping accommodations for less than 30 days by establishments with five or more.

The State Tax Costs Of Doing Business Location Matters 2021

Ohio Taxation Ohiotaxation Twitter

Working From Home Ohio Is Still Figuring Out How To Tax You

Ohio Laws Ohio Tax Liens Libguides At Franklin County Law Library

The First Post Trump Republican Race The New Yorker

Baker Proposes 700m In Tax Breaks For Residents Take A Look At The Details The Boston Globe

Bankruptcy Domestic Relations Tax Lawyer 4 Ohio Locations Sheppard Law Offices

Coronavirus Tax Relief Covid 19 Tax Resources Tax Foundation

Income Tax Preparation Services Akron Ohio 1040 1065 1120

Did Ohio Municipal Tax Reform Really Simplify The Tax Process Marcum Llp Accountants And Advisors

Ohio Agency Approves Intel Tax Incentives That Could Hit 650 Million

Fieldhouse Usa Land Subject Of Suit Against Polaris Mall

Ohio Employer Local Income Tax Withholding Obligations Cultivate Works Small Business Support

State Taxes On Capital Gains Center On Budget And Policy Priorities

Sold Tax Lien Certificates Treasurer

How Can I Find Financial Help In Ohio During Coronavirus Wtol Com